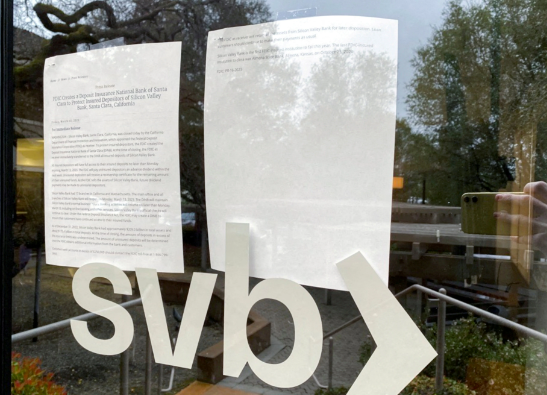

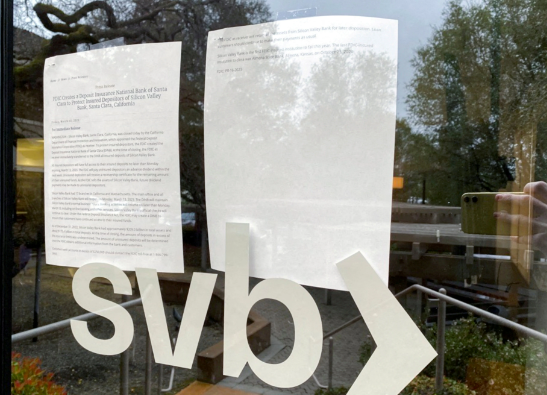

Why Did Silicon Valley Bank Collapse?

Silicon Valley Bank is largest failure since 2008 crisis, billions stranded

실리콘 밸리 은행은 2008년 위기 이후 최대 실패, 수십억 달러가 발이 묶였습니다

Startup-focused lender SVB Financial Group became the largest bank failure since the 2008 financial crisis on Friday, in a sudden collapse that roiled global markets and left billions of dollars belonging to companies and investors stranded.

스타트업 중심의 대출 기관인 SVB Financial Group은 금요일 세계 시장을 뒤흔들고 기업과 투자자에게 속한 수십억 달러를 좌초시킨 갑작스러운 붕괴로 인해 2008년 금융 위기 이후 최대 은행 파산이 되었습니다.

In California, silicon valley bank has collapsed and signature bank has been collapsed. Silicon valley bank was a parent company of signature bank and both banks were owned by Wells Fargo Bank (WFC). WFC is also known as one of America's biggest banks with assets exceeding $3 trillion dollars.

캘리포니아에서는 실리콘밸리 은행이 무너지고 signature 은행이 무너졌습니다. 실리콘 밸리 은행은 signature 은행의 모회사였으며 두 은행 모두 Wells Fargo Bank(WFC) 소유였습니다. WFC는 또한 자산이 3조 달러가 넘는 미국 최대 은행 중 하나로 알려져 있습니다.

This banking crisis has also affected the stock market, which is one of the most important factors in our economy, because it helps determine what products or services people can buy and how much money they receive from their paycheck each week.

이러한 은행 위기는 우리 경제에서 가장 중요한 요소 중 하나인 주식 시장에도 영향을 미쳤습니다. 주식 시장은 사람들이 어떤 제품이나 서비스를 살 수 있는지 그리고 매주 급여에서 얼마를 받을 수 있는지를 결정하는 데 도움이 되기 때문입니다.

The genesis of SVB's collapse lies in a rising interest rate environment. As higher interest rates caused the market for initial public offerings to shut down for many startups and made private fundraising more costly, some SVB clients started pulling money out.

SVB 붕괴의 기원은 상승하는 금리 환경에 있습니다. 높은 이자율로 인해 많은 신생 기업의 IPO 시장이 폐쇄되고 개인 자금 조달에 더 많은 비용이 들게 되면서 일부 SVB 고객이 자금을 인출하기 시작했습니다.

The company was not, at least until clients started rushing for the exits, insolvent or even close to insolvent. But banking is an enterprise that relies as much on confidence as on cash — and if that runs out, the game is over.

회사는 적어도 고객이 파산 또는 파산에 가까운 출구를 찾기 위해 서두르기 시작하기 전까지는 그렇지 않았습니다. 그러나 은행은 현금만큼이나 신용에 의존하는 기업입니다. 신용이 떨어지면 게임이 끝납니다.

It isn’t clear if the bond sale or the fund-raising, at least initially, had been made under duress. It was meant to reassure investors. But it had the opposite effect: It so surprised the market that it led the bank’s very smart client base of venture capitalists to direct their portfolio clients to withdraw their deposits en masse.

적어도 처음에는 채권 매각이나 자금 조달이 강압에 의해 이루어졌는지는 확실하지 않습니다. 투자자들을 안심시키기 위한 것이었습니다. 그러나 그것은 정반대의 결과를 낳았습니다. 그것은 시장을 너무 놀라게 해서 은행의 매우 똑똑한 벤처 투자자 고객 기반이 그들의 포트폴리오 고객들에게 예금을 한꺼번에 인출하도록 지시하도록 이끌었습니다